Last month, we revisited this survey data to look at which service criteria has the biggest impact on subscriber loyalty or NPS® for the top four internet providers compared to other alternatives .

Ultimately, we found that subscribers to the top internet providers were looking for faster download speeds and responsive customer service while those who have service with an alternative provider were more focused on reliability and a seamless internet experience. This month, we’d like to discuss differences in how people use the internet as the basis for behavioral segmentation. Specifically, which internet activities and beliefs distinguish different types of users.

Defining Three Behavioral Segments

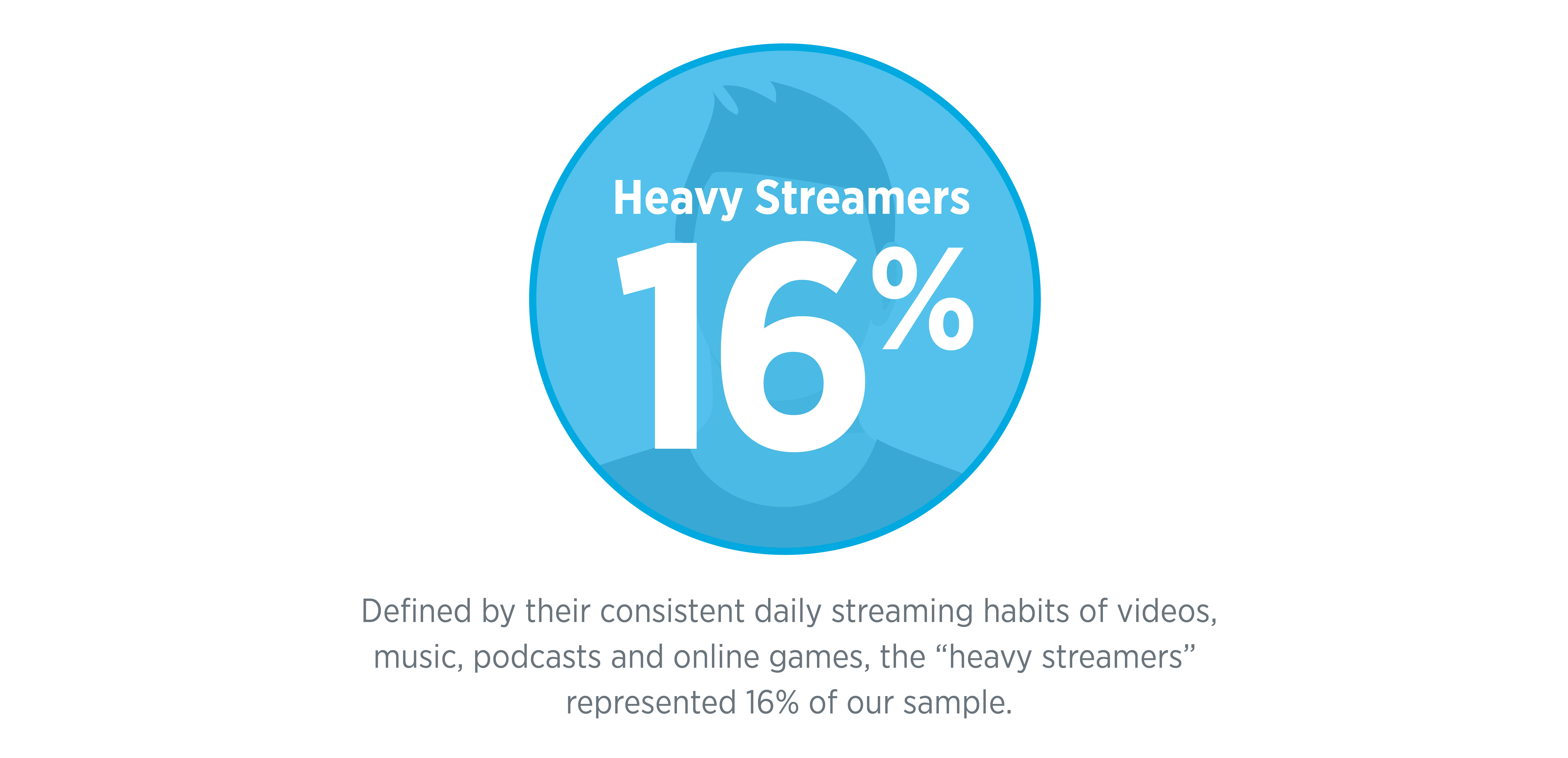

We asked survey respondents how frequently they used their home internet for common daily activities such as emailing, surfing, shopping and even working from home. Four activities stood out—streaming videos, streaming music, listening to podcasts and online gaming. These, in conjunction with perceived home internet download speeds and service tier, yielded the three distinct streaming segments seen in the infographic below.

Discover more PDFs Website hosting services CSS code cleaner Source code cleaner Code validation tools HTML editor Responsive web design guide HTML cleaning subscriptions Text editor tool Copy HTML code

Prioritizing Your Marketing Strategy Around User Behaviors

Each of the three behavioral user segments has its own set of internet service beliefs and level of openness to switching providers. As an internet provider, you should strive to align your marketing efforts with these beliefs and the streaming habits of your customer base. In order to win over the different segments, you have to speak the language of what each group wants.

As you develop your marketing initiatives, we recommend that you consider the following four strategies to increase the chances of expanding your selected segments.

- Segment your service packages better—The objective here is to design an internet product or package to meet the needs of each segment. We want to enable the customer segments to “match” their internet streaming behavior with a solution that better serves their needs versus just promoting the speed of the service. Consider labeling the packages accordingly so users can identify with the product and know it is tailored to their needs. We need to move beyond basic to premium service classifications.

- Target segments with digital media—Match your digital marketing strategy to the most frequent activities of your selected behavioral user segments. Consider meeting your customers where they need their internet to work hardest on a daily basis. In other words, deliver the right message at the right time.

- Leverage your database to meet customer needs—Your existing customer database can provide valuable insight into the behavioral segments of your respective markets. Consider targeting your new “productized” packages and price points around households that best fit your selected behavioral segment.

- Implement a proactive retention effort—Given poor NPS® scores across all three behavioral segments and the likelihood of switching providers, implement a customer satisfaction tracking program to monitor customer satisfaction levels. Be prepared to implement trigger-based programs to address customer churn before it happens.

Be sure to stay tuned for our final blog post revisiting our national home internet survey next month. If you would like to discuss these findings, please feel free to contact us directly.